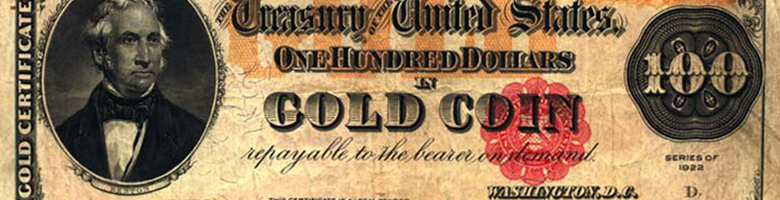

Gold Standard

Off and on until as late 1971, US currency was convertible to gold on demand. This was the “gold standard,” meaning you could trade your paper money for actual gold, making it representative money. President Nixon officially ended international convertibility of the U.S. dollar to gold on August 15, 1971. Since then, US currency is fiat money, meaning it isn’t backed by, nor can it be converted to a precious metal or other commodity.

Fiat money only works if everyone trusts it will be accepted by other people as a means of payment for liabilities. Which translates to trust in the government that is issuing the fiat money. The US dollar is the most stable fiat currency in the world because everyone else in the world trusts that the US government and the economy of the US will still be there tomorrow to back their currency.

In a fiat money system, when trust falters, the value of the currency falls. This can be a result of socioeconomic crisis or political crisis—basically when bad things happen, people lose faith in the system and quit believing the money has worth. It can also be the result of increasing the money supply too fast. While it is more nuanced, there is an economic impact to printing more paper money as it requires a higher level of trust in the ability of the government to back it.

Leaders have their own economies. There are lots of things being exchanged in the course of a person working for a company, with only one of them being pay. All the rest are forms of currency that rely, to a large degree, on the trust we have in one another and even more on the trust we have in leadership. When that trust is high, the economy experiences healthy growth and stability. When that trust fails, the economy collapses.

When leaders make good on their promises, their leadership currency holds its value. The problem is that while not every leader makes these promises, every team member believes they should and holds leadership accountable for them. In other words, we know what life at work should feel like, and we expect our leaders to back that up with their actions.

A few of the forms of “currency” in our leadership “economies” are safety, growth, opportunity, and a share of the rewards.

People have an innate desire to be safe and free from the threat of harm. Leaders should proactively protect people from physical, mental, or emotional harm. People shouldn’t have to ask to be kept safe.

People want to grow as individuals and increase their capabilities and capacities. Some leaders are threatened by the people around them outgrowing or outperforming them. This is very shortsighted and leads to the best people finding a new “economy.”

People need opportunities and options to move as they grow. These don’t all have to be promotions. Being part of a special project, having an idea implemented, or even just being asked for an opinion are all ways that we can give people opportunity.

People deserve a share of the results they help create. This is often thought to be limited to money, but it encompasses everything from simple recognition to access. Our “economies” produce a wide array of rewards that can be shared.

Leaders must use their currency carefully and realize that it is functionally a fiat currency; only as good as the track record we have of making good on the promises of leadership. Done well, our economy will flourish and grow, and people will treat our leader’s currency like a gold standard, guaranteed and backed by the commodity of trust, which is the Bison Way.